tax act stimulus check error

If so you dont qualify for the first or second. 2 days agoThe tax rebates would be directly tied to the amount of revenue collected from the higher tax and profits would need to climb higher than 110 in.

Camps Intuit Com Quickbooks Accounting Browser Icon

If the amount of your check was based on a 2018 or 2019 tax return where the IRS identified a Math Error and the Math Error.

. If you are due an additional amount it will be issued as a Rebate Recovery Credit RRC on line. We mailed these notices to the address we have on file. You did not provide a Social Security number thats valid for employment.

We use chase for our bank. The IRS did incorrectly send some stimulus payments to the wrong bank account. It cannot be cashed out anyway as it would constitute federal fraud.

I used Tax Slayer and am having the same problem. 600 in December 2020January 2021. TurboTax and HR Block customers are reportedly struggling to get their stimulus checks once again but officials say the problems are less widespread this time around.

Im so confused on whats going on and our stimulus is no where to be found. Shows the first. Upon realization of this error the IRS instructed financial institutions to return the funds to them which is required by law and stated they would reprocess those funds to the recipients.

Heres a list of what some people are doing wrong. If you have not received a check by mid-September you can call the TAS. If you suspect an error you should report this to the IRS at 800-829-1040 and take steps to resolve this.

Individual Income Tax Return Form 1040-X to claim the creditThe IRS will not calculate the 2020 Recovery Rebate Credit for you if you did not enter any amount on your original 2020 tax return. So I just filed my taxes online for free via tax act which IRSgov sent me to and one of the questions was did you receive a third stimulus for 1400 for a moment I was confused and didnt know there was a third stimulus so I said no. The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor We filed with Tax Act and had our fees taken out of our return.

We filed with Tax Act and had our fees taken out of our return. Securely access your individual IRS account online to view the total of your first second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page. The IRS sent some of the stimulus payments to inactive or closed bank accounts.

People who do not receive their stimulus payment by the January 15 deadline will have to wait to claim their stimulus check as a tax credit. 10 2021 we announced the IRS has committed to reprocessing stimulus payments directly to our customers impacted by the IRS payment error. This decision was made after days spent advocating for our customers and pushing the IRS to rightfully send these much-needed stimulus dollars quickly to our customers.

1200 in April 2020. After completing it I e-filed my taxes. Transcript says 14 and the check my payment or whatever its called shows status not available.

You were claimed as a dependent on another persons 2020 tax return. The IRS asks the relatives to return the check. We have been working.

Please try the following steps if you are using TurboTax Online to see if the error message will clear. Tax shift for large corporations not likely until next year The IRS says it is fixing an error that prevented millions of people who. A check was issued in the name of a single deceased person - the check was sent in error.

Dozens of people who filed. Tax act stimulus check error Wednesday April 20 2022 The IRS began sending supplemental payments to people whose stimulus checks were based on their 2019 tax. Yes if your 2020 has been processed and you didnt claim the credit on your original 2020 tax return you must file an Amended US.

However there is also a chance that you miscalculated how much money you would receive. This IRS error caused some people to not receive their stimulus payment. You can also refer to the IRS Statement Update on Economic Impact Payments I received my tax refund via check from the IRS how will I get my stimulus payment.

Many taxpayers can expect to. You tried to claim stimulus money which you wouldnt. Your Online Account.

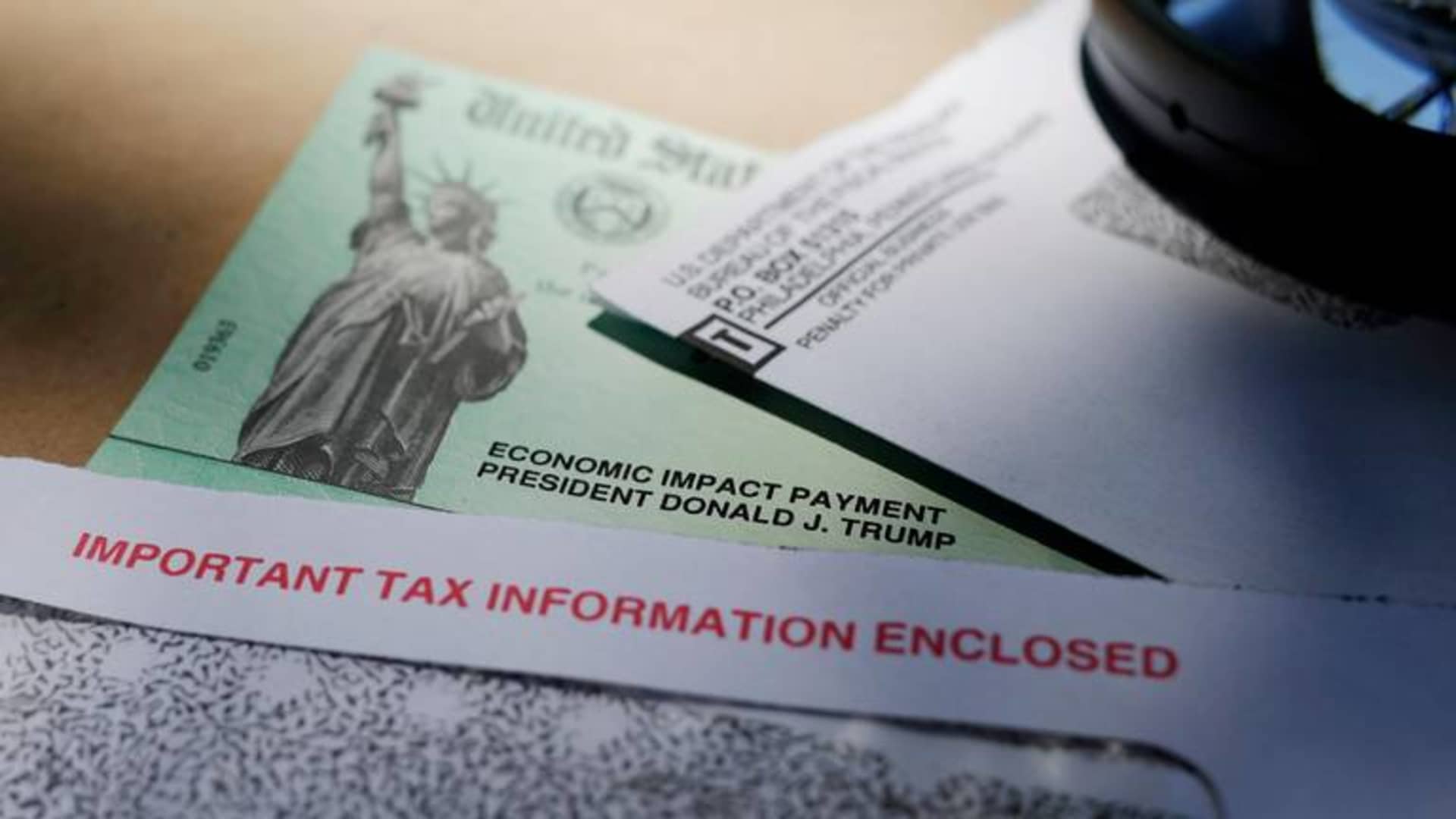

These payments were sent by direct deposit to a bank account or by mail as a paper check or a debit card. The TurboTax software adds together the entries that you made for receiving stimulus check 1 and stimulus check 2. But the amount you claim could be adjusted by the IRS the.

This years tax season has brought with it a new opportunity to collect any unpaid funds from previous rounds of federal stimulus checks. Stimulus payments for millions of TurboTax customers affected by the IRS error will be deposited starting today spokeswoman Ashley McMahon said in an email to NBC News. COVID-19 Stimulus Checks for Individuals.

It told me my tax refund and the 3rd stimulus of 1400. The IRS issued a stimulus payment based on the 2018 tax return information - that payment is an error. Stimulus payments erroneously sent to closed or incorrect bank accounts by the IRS are being redirected according to tax preparation companies affected by the mistake.

You are supposed to pay it back. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible. Please see Second Stimulus Payment Timing FAQs for the most up-to-date information regarding this issue.

Go to Federal on the left side of the screen Go to Wages Income at the top of the screen Scroll to the bottom of the section without making any changes and click Wrap Up. 1400 in March 2021. Then the software computes the amount of your stimulus check amounts based upon the information that has been entered into the tax software.

This Is Why You May Not Get The Third Stimulus Check Best Life Emprego Mudar Direito

Your Stimulus Check May Not Come Until 2021 The Washington Post

Don T Lose That Irs Letter About Your Third Stimulus Check Here S What To Do With It Cnet

4 Best Online Proofreading Tools For Error Free Writing Verb Forms Grammar Mistakes Writing

Where S My Third Stimulus Check Turbotax Tax Tips Videos

The Irs Stopped Accepting Direct Deposit Requests On May 13 That Doesn T Mean You Won T Get A Check However Irs Filing Taxes Deposit

Filed As Resident In 2018 Left The Us Received Stimulus Check

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

How Nonfilers Can Get Stimulus Checks Including Those Experiencing Homelessness Cnet

Your Third Stimulus Check Can Be Seized Here S What To Know Cnet

Stimulus Checks Tax Returns 2021

Stimulus Checks Waiting For People With Little Income And No Income

American Rescue Plan How To Get These 1 400 Payments Marca

Americans Struggle To Receive Missing Stimulus Checks

Second Stimulus Check Update Heroes Act Passes In The House Saturday May 16th Youtube Small Business Administration Hero Acting